Dans un monde de plus en plus digital, où la mobilité des capitaux est facilitée et l’ingénierie fiscale de plus en plus sophistiquée, la fraude fiscale s’estime en France à 100 milliards d’euros[1]. Dans ce contexte, le législateur a dû réagir en renforçant le dispositif réglementaire existant.

Ainsi, l’entrée en vigueur prochaine de la Directive EU 2018/822, dite DAC6 (Directive on Administrative Cooperation 6), vient modifier la directive 2011/16/EU pour mieux prémunir le Trésor contre une potentielle flambée des pratiques fiscales dites « agressives ».

Quel est l’objet de cette directive ?

La DAC6 définit le cadre de coopération administrative entre les états membres, en imposant notamment une déclaration des accords transfrontières dits « agressifs » ; ainsi que l’échange automatique des informations entre les pays membres.

Cette Directive a pour objectif de renforcer la transparence fiscale et réduire « l’évasion fiscale » afin de mieux protéger la base d’imposition des États membres.

Dans quel cas soumettre une déclaration ?

Comme évoqué, seules les opérations dont le caractère est jugé « agressif » seront soumises à une obligation de déclaration ; le caractère agressif étant apprécié à l’aide des 14 marqueurs suivants :

Quels acteurs sont concernés ?

La DAC 6 s’applique principalement aux :

- Intermédiaires s’ils ont un lien avec l’UE,

- Eventuellement aux contribuables tirant parti du dispositif (s’il s’agit d’un dispositif interne) [2] et n’ayant pas de lien d’appartenance à un état membre de l’UE.

Au sens de la DAC 6, un intermédiaire est soit un :

- Concepteur : acteur orchestrant la mise en place et la gestion du dispositif transfrontière,

- Prestataire de services : fournisseur de services financiers et/ou fiscaux, typiquement les cabinets d’avocats, comptables, institutions financières sur les lignes métiers services d’investissement et gestion d’actifs.

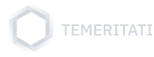

Ci-dessous, un tableau illustrant la responsabilité de la déclaration dans les différents cas de figure:

Note : si l’intermédiaire est soumis au secret professionnel, l’autorisation de déclaration devra impérativement être demandée au contribuable.

Quels services seront potentiellement impactés ?

La prédominance des institutions financières dans les activités d’intermédiation, met ces dernières en première ligne face aux exigences de la DAC6 notamment sur les lignes métier ci-dessous:

Quand et que faut-il déclarer ?

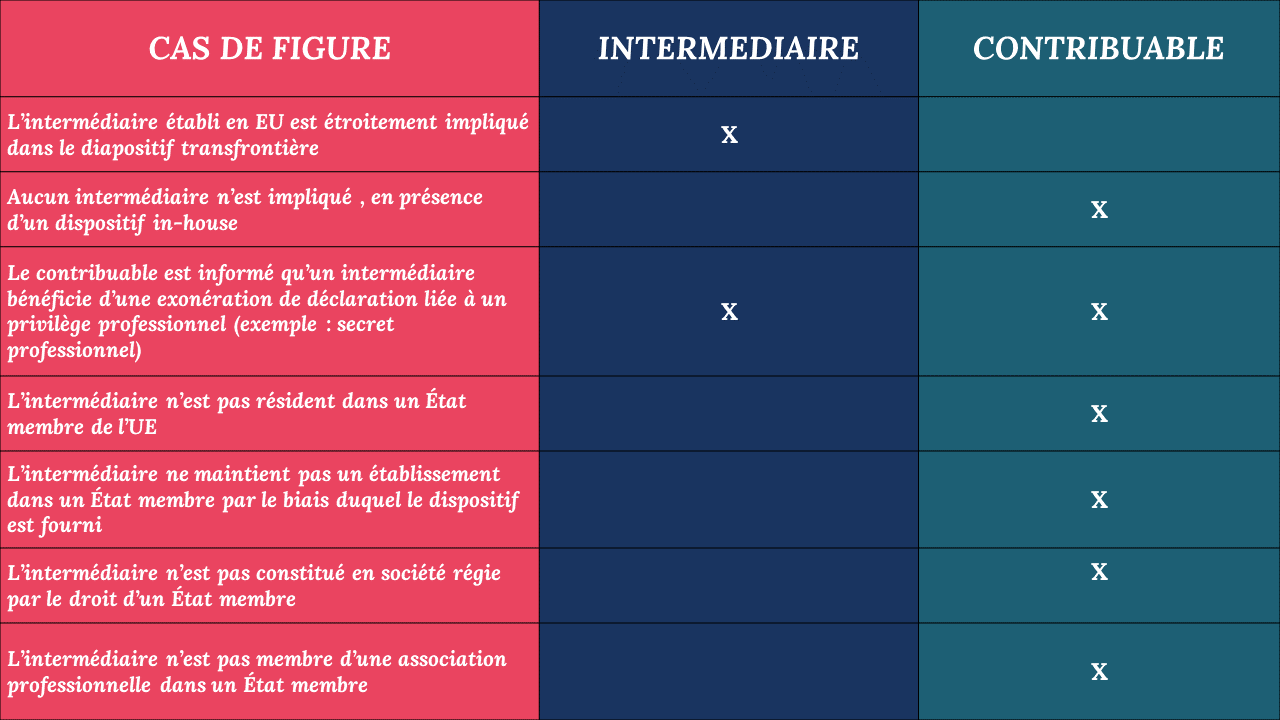

Fait important, la directive DAC6 est rétroactive, ainsi tout dispositif transfrontière dont la première étape a été mise en œuvre à compter de la date d’entrée en vigueur (25 juin 2018) est concerné par l’obligation de déclaration.

La date initiale de début de déclaration était prévue au 31 août 2020 pour la période transitoire (dispositifs du 25 Juin 2018 au 30 Juin 2020), cependant en raison de l’instabilité provoquée par le COVID-19, la Commission Européenne a accordé la possibilité d’un décalage de cette date de début de déclaration. Ce décalage pouvant aller jusqu’à six mois, soit jusqu’au 28 février 2021, en laissant latitude à chaque pays dans la définition de la date précise de mise en application.

Note : A compter du 01/01/2020, tout dispositif initié doit être déclaré dans les 30 jours.

A titre d’exemple une prolongation de six mois a été adoptée en France et en Belgique, tandis que la Finlande a choisi de ne pas reporter la date initiale.

Concernant les informations à déclarer, le timing est crucial, puisqu’à la récupération des informations la déclaration doit s’effectuer dans les 30 jours et englober les éléments suivants :

- La liste de tous les contribuables et intermédiaires impliqués (résidence fiscale, nom, numéro d’identification fiscale, personnes associées du contribuable concerné et date et lieu de naissance s’il s’agit d’une personne physique) ,

- Les marqueurs détectés dans le dispositif ,

- Résumé des dispositions à déclarer ,

- La date de mise en œuvre de la première étape du dispositif ,

- Les dispositions fiscales nationales applicables ,

- Avantage fiscal ou valeur de la transaction (si disponible) ,

- Autres juridictions impliquées ou concernées.

Quelles conséquences pour les acteurs concernés ?

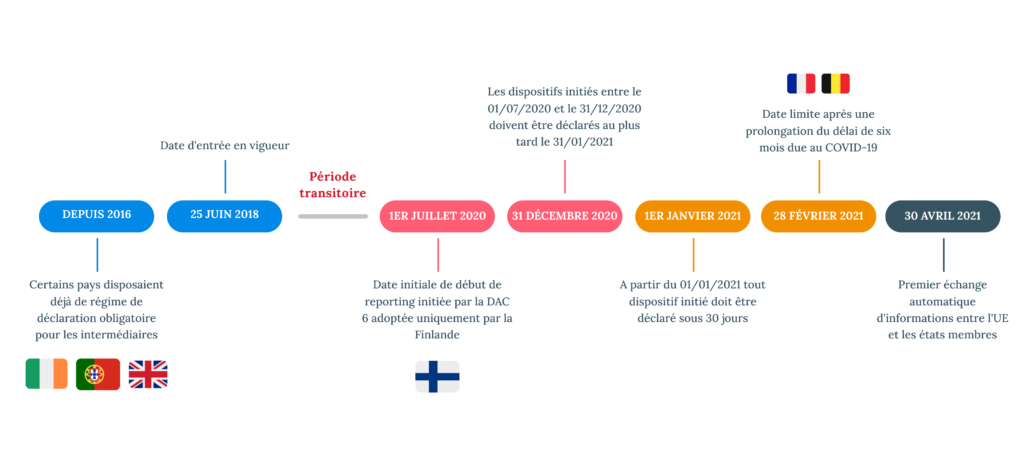

Compte tenu de l’étendue des initiatives du DAC 6 et leur complexité, les acteurs concernés se retrouvent face à de nouveaux défis pour remplir les exigences de cette dernière, ce qui nous amène à mettre en exergue les challenges à relever face à cette réglementation au travers des axes ci-dessous :

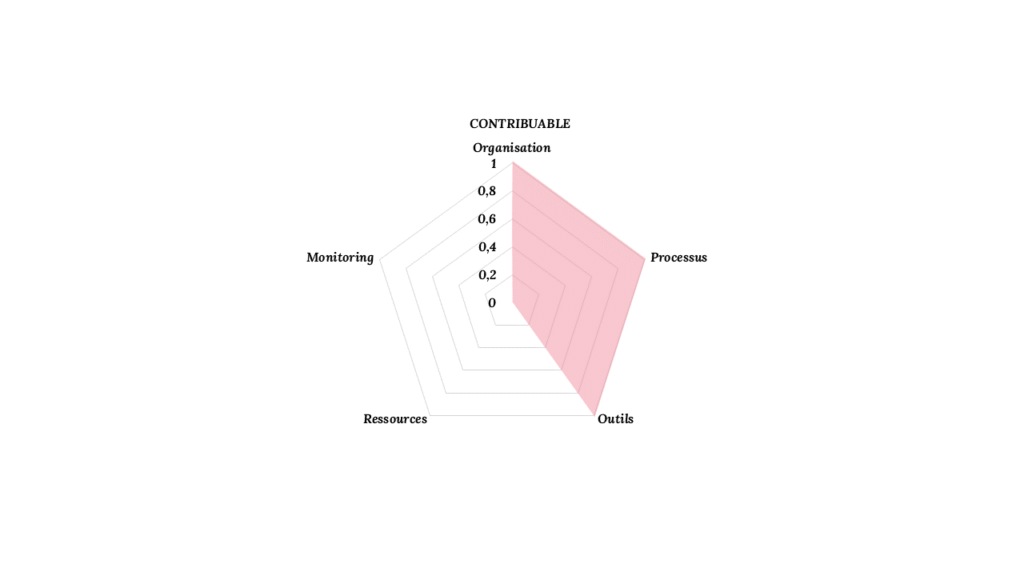

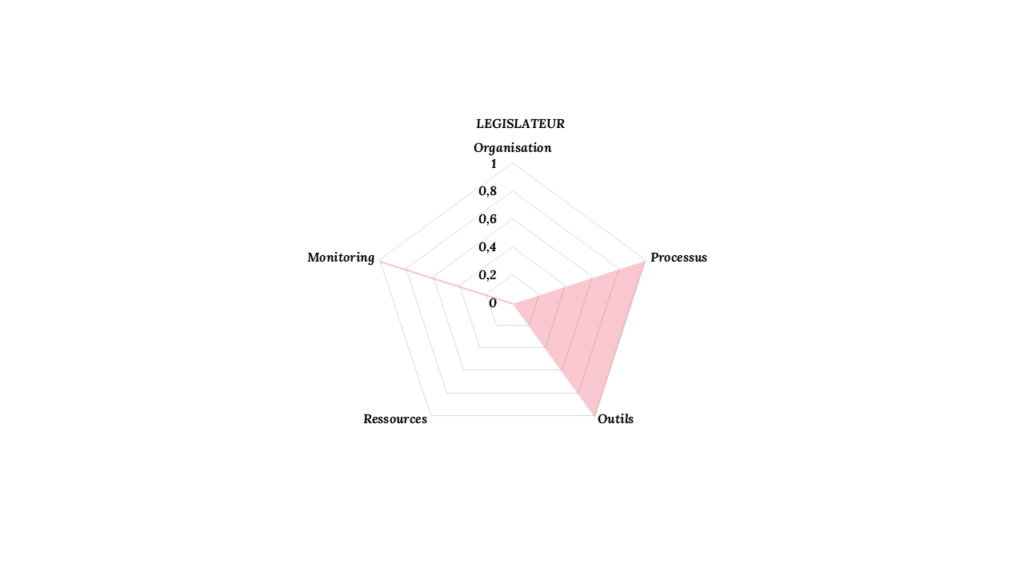

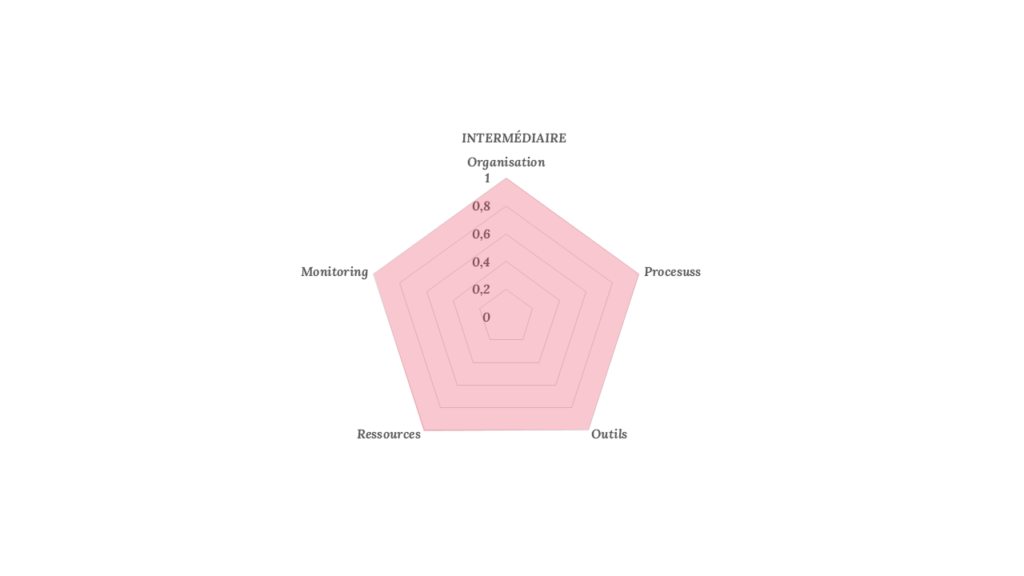

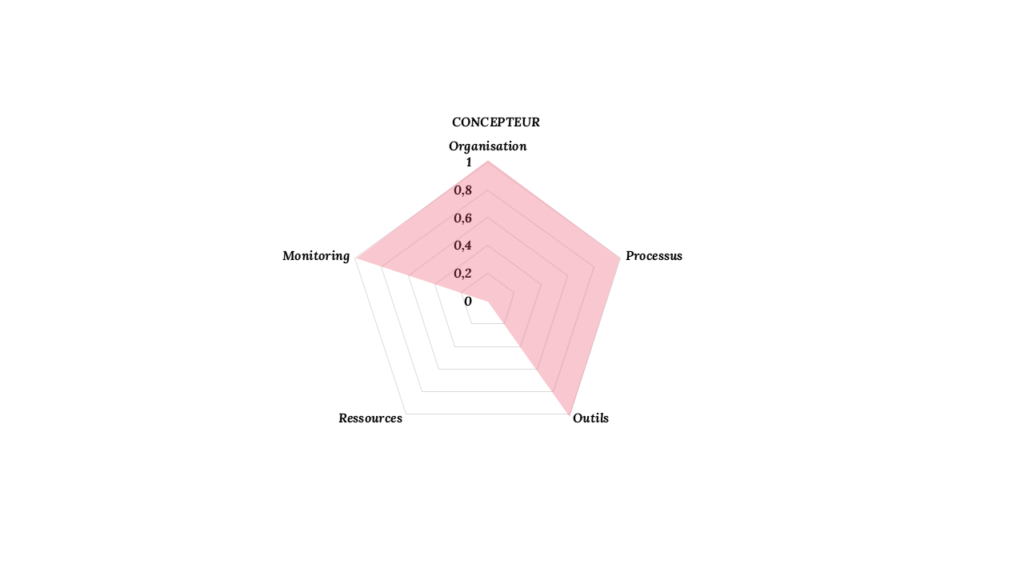

La mesure d’impact par acteur suivant les axes mentionnés ci-dessus est comme suit :

Ainsi, le prérequis à toute initiative de mise en conformité à cette directive est l’analyse de son impact sur votre organisation (activités, lignes produits, services…) au travers des prismes évoqués pour appréhender le périmètre à adresser et la complexité de mise en œuvre.

Les initiatives induites par cette analyse d’impact auront pour objectif la définition d’un modèle opérationnel cible, d’un socle technique (référentiels clients et produits, reporting …) et des processus & contrôles permettant de répondre aux contraintes nouvelles de cette règlementation.

TEMERITATI vous accompagne

Cabinet de conseil en management avec une ligne métier dédiée aux sujets de mise en conformité réglementaire ; nos références sur ce type de sujets (notamment FATCA, CRS, MIFID, LAB/FT) nous permettent d’avoir une maitrise de la démarche à déployer dans les phases de cadrage, de conception et de mise en œuvre.

Vous êtes en charge des sujets règlementaires au sein de votre établissement ?

Vous vous posez des questions sur votre portefeuille projet, notamment sur la mise en conformité DAC 6 ?